Retail demand in India is no longer driven only by big malls or legacy high streets. Over the last few years, a quieter but far more resilient retail format has emerged—retail shops located near dense residential catchments. These neighbourhood retail hubs are now among the most consistently performing assets across urban and semi-urban markets.

Yet most online content treats this segment generically, often repeating clichés like “daily needs drive footfall.” That explanation is incomplete. The real demand story is shaped by lifestyle changes, time economics, urban planning gaps, and consumer psychology. This article offers a clear, on-ground demand analysis of retail shops near residential catchments—what drives success, what fails, and why.

Understanding Residential Catchment–Driven Retail

A residential catchment refers to the population living within walking or short driving distance of a retail cluster. In practical terms, this includes apartment complexes, gated communities, plotted developments, and mixed-use townships.

Retail shops near such catchments rely less on destination travel and more on habitual consumption. This makes their demand profile fundamentally different from mall-based or highway-facing retail.

Why Demand Is Rising for Neighbourhood Retail

Time Scarcity Is the New Demand Driver

Modern urban households value time more than variety. With longer work hours, hybrid schedules, and congested roads, consumers increasingly prefer convenience over choice. Retail located near homes reduces friction—no parking hassles, no long travel, no planning required.

This behavioural shift has structurally increased demand for retail within residential influence zones.

Daily-Use Consumption Is Recession-Resilient

Retail formats serving groceries, pharmacies, food & beverage, clinics, salons, and essential services enjoy non-discretionary demand. Even during economic slowdowns, consumption does not stop—it simply becomes more localized.

This makes residential catchment retail far more stable than destination retail formats.

The Changing Profile of Retailers Entering Residential Zones

Earlier, neighbourhood retail was dominated by unorganized mom-and-pop stores. Today, organized brands actively seek residential-facing locations.

Quick commerce dark stores, café chains, cloud kitchen front-ends, diagnostic labs, boutique fitness studios, and service brands prefer catchment-led footfall over mall dependency. These brands prioritize repeat customers, not one-time visitors.

This shift has raised both rental benchmarks and tenant quality.

Location Quality Matters More Than Frontage

One major content gap in existing articles is the assumption that all residential catchments perform equally. They don’t.

Demand is strongest where:

- Population density is high and stable

- Household income levels support discretionary spending

- Pedestrian access is easy and visible

- Competing retail is limited or fragmented

Retail shops buried inside poorly planned layouts or oversupplied commercial complexes struggle, regardless of residential proximity.

Rental Performance and Absorption Trends

Retail shops near strong residential catchments show faster absorption and lower vacancy compared to high-street or mall retail in many cities. Rents grow steadily rather than sharply, which supports long-term sustainability.

Tenants prefer slightly higher rent in a reliable catchment over cheaper space with unpredictable footfall. This explains why many neighbourhood retail clusters maintain occupancy even when larger retail assets face churn.

Consumer Behaviour: Repeat Over Discovery

Residential retail thrives on frequency, not novelty. Consumers return to the same grocery store, café, or pharmacy multiple times a week. This repeat behaviour creates predictable revenue streams for retailers.

Unlike destination retail, marketing costs are lower because footfall is organic. This improves tenant profitability and increases lease longevity.

Risks and Common Mistakes Investors Make

The biggest risk is overestimating demand based solely on residential presence. A large number of housing units does not automatically translate into spending power or retail viability.

Another mistake is ignoring tenant mix planning. Too many similar stores cannibalize each other, weakening overall performance.

Investors also overlook parking, visibility, and last-mile access—factors that directly impact retailer success.

Investor Perspective: Why Residential Catchment Retail Is Favoured

From an investment standpoint, retail near residential catchments offers defensive returns. Yields may not spike overnight, but income stability is high.

Institutional and seasoned investors prefer such assets because they are:

- Less vulnerable to e-commerce disruption

- Supported by essential consumption

- Easier to lease and re-lease

The focus here is income consistency, not speculative appreciation.

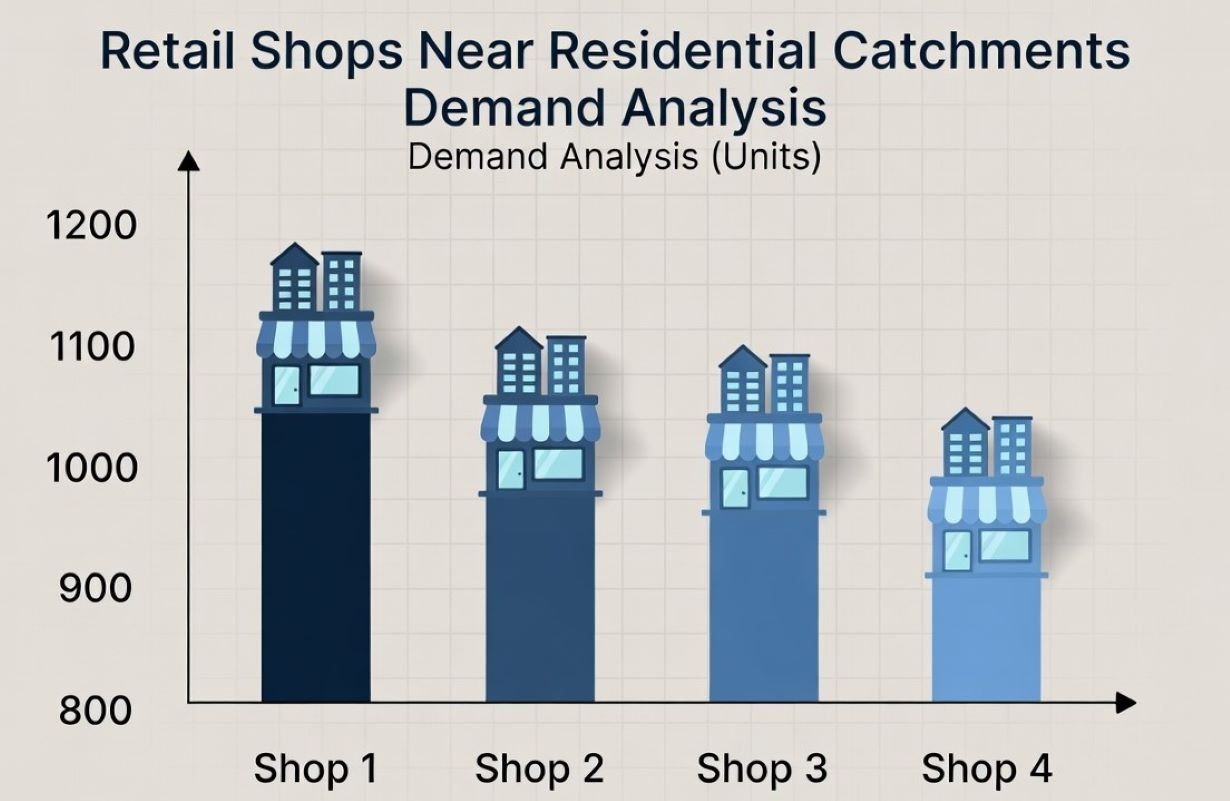

What the Demand Analysis Clearly Shows

Demand for retail shops near residential catchments is structural, not cyclical. It is driven by urban lifestyle changes, not temporary market conditions.

However, success depends on micro-location quality, planning discipline, and tenant alignment. When executed correctly, residential catchment retail consistently outperforms many traditional retail formats on stability and risk-adjusted returns.

FAQs: Retail Shops Near Residential Catchments

Why do retail shops near residential areas perform better?

Because they serve daily and repeat consumption needs, reducing dependence on discretionary or destination-based footfall.

Which retail categories work best near residential catchments?

Grocery, pharmacy, F&B, clinics, salons, fitness, and essential services perform strongest.

Are rentals lower than high-street retail?

Not always. In strong catchments, rents can match or exceed average high-street levels due to demand stability.

Is residential retail safe during economic downturns?

Relatively yes. Consumption shifts locally rather than disappearing.

What should investors check before buying such retail?

Population density, income profile, visibility, access, competing supply, and tenant mix potential.

Join The Discussion